The New Zealand Dollar (NZD) is under pressure due to concerns about the country's economic growth, exacerbated by bearish technical indicators and the US Dollar's strength. Recent data showing negative growth in New Zealand, with GDP contracting by 0.1% in Q4 2024, suggests a recession. Despite this, the Reserve Bank of New Zealand (RBNZ) has not signaled readiness to cut interest rates, citing relatively elevated inflation at 4.7% in Q4. Expectations for an initial interest-rate cut by the RBNZ in August are based on consensus estimates from Reuters. The New Zealand government, represented by Finance Minister Nicola Willis, also desires lower interest rates to stimulate growth amid economic slowdown, partly attributed to China's economic slowdown, affecting demand for New Zealand's main export, dairy goods.

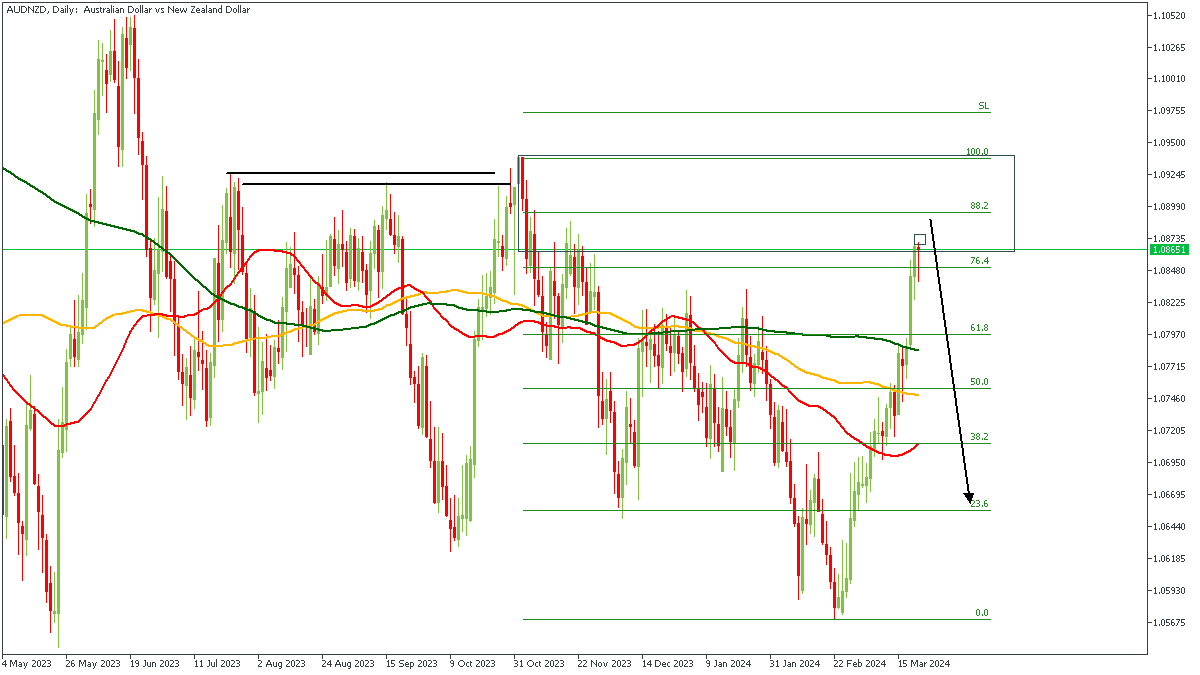

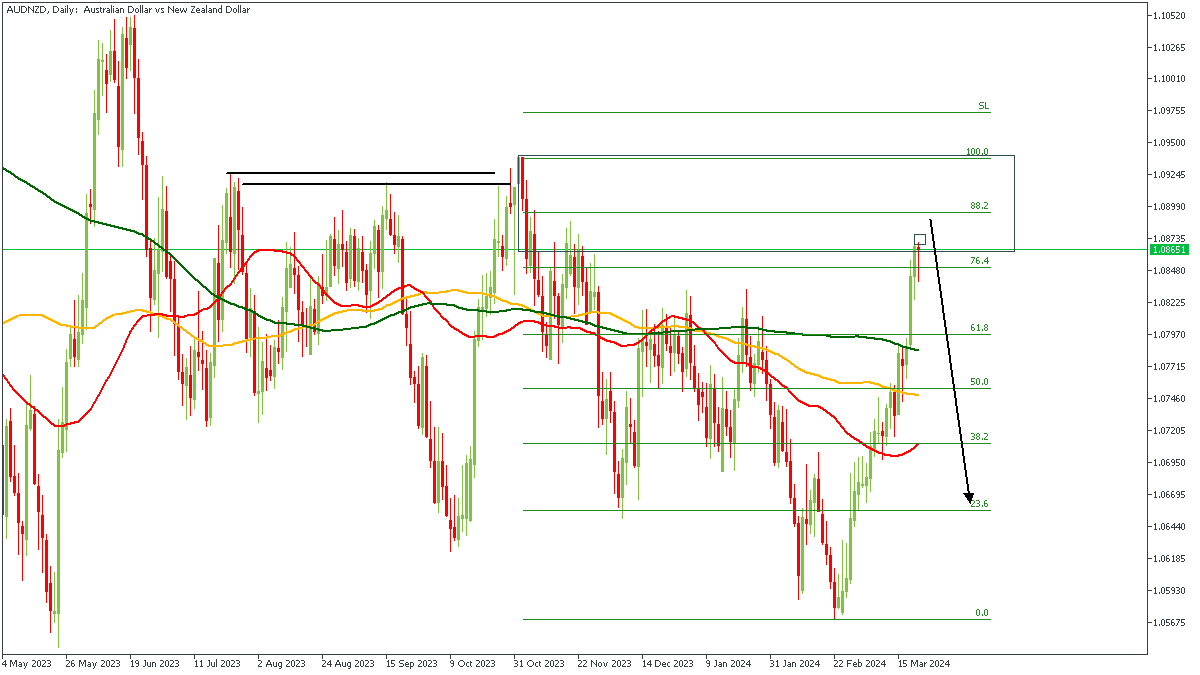

AUDNZD - D1 Timeframe

AUDNZD is currently trading within the Daily timeframe rally-base-drop supply zone, whilst the moving averages clearly indicate a bearish trend could be in play. In line with this, I have plotted a Fibonacci retracement of the previous market swing, leading me to expect a reversal from around the 88% of the Fibonacci retracement level.

Analyst’s Expectations:

Direction: Bearish

Target: 1.06952

Invalidation: 1.09423

NZDCAD - D1 Timeframe

As seen in the attached chart, price action on the daily timeframe of NZDCAD is currently approaching a pivot zone, as well as a trendline support; the 88% of the Fibonacci retracement being a crucial price point can also be seen fitting snuggly within the pivot zone. My sentiment based on all of these is bullish!

Analyst’s Expectations:

Direction: Bullish

Target: 0.82771

Invalidation: 0.80790

NZDJPY - D1 Timeframe

NZDJPY has had a swift, interesting climb in recent times, going all the way to fill the imbalance from the previous swing down. The sharp drop seen at the moment, however, can be considered a retracement in my opinion since we can see the overall trend remaining largely bullish. Also, there is a confluence of support trendlines, as well as the demand zone, bullish array of the moving averages, and the moving average support.

Analyst’s Expectations:

Direction: Bullish

Target: 92.555

Invalidation: 90.307

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.