Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

2024-02-23 • Updated

On Friday, the gold price (XAUUSD) retreated from a recent two-week high, facing selling pressure. This decline was driven by hawkish minutes from the FOMC meeting, indicating the Fed's reluctance to cut interest rates. Elevated US Treasury bond yields, supported by a "higher-for-longer" narrative, further weakened demand for gold, as investors favored yield-bearing assets. However, the US dollar struggled to gain momentum, staying near three-week lows, potentially supporting gold as a safe-haven asset amid geopolitical tensions in the Middle East. Moving forward, market attention will focus on US bond yields and USD dynamics, with short-term opportunities in XAUUSD influenced by broader risk sentiment.

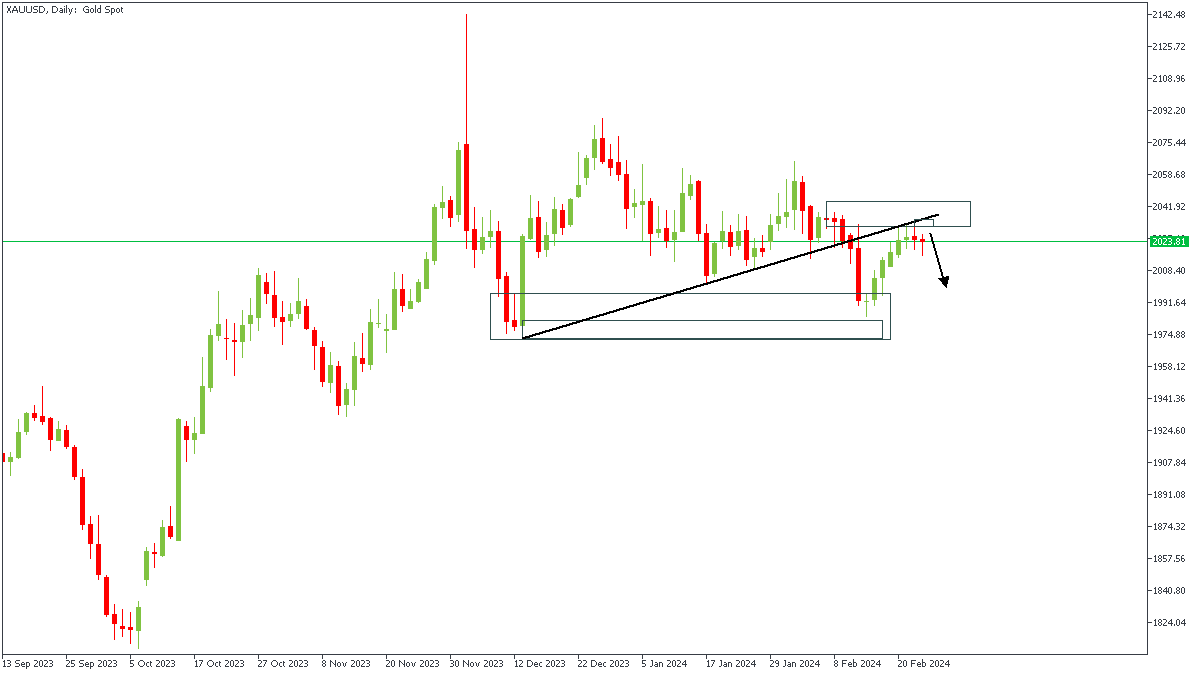

Price action on the daily timeframe of XAUUSD shows price currently reacting from the rally-base-drop supply zone, albeit in a subtle manner. We also see that the previous low has been broken, which means that price can be said to have completed the retracement. The added confluence to this is the trendline resistance that price seems to also be reacting to at this time.

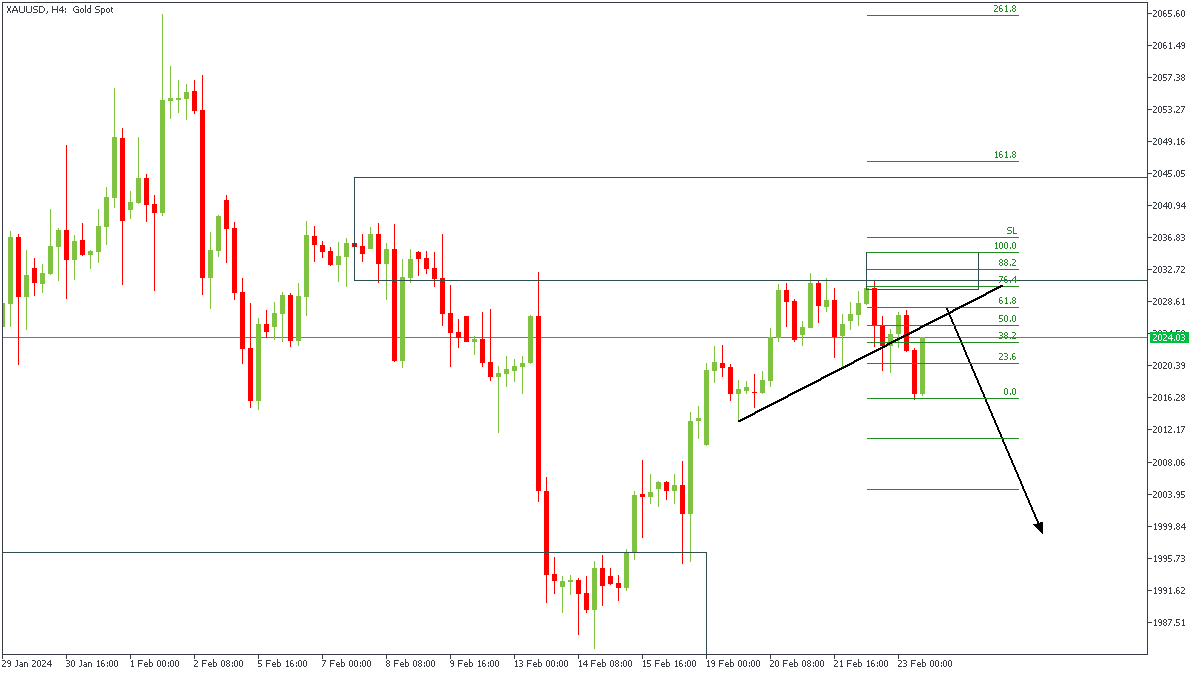

After reacting from the supply zone on the daily timeframe, here on the 4-hour chart of XAUUSD, we see that a change of character has already occurred from the recent break of structure. Following this, I expect to see a proper rejection from the trendline resistance and the Fibonacci retracement level. My target for this idea is the previous demand zone as shown on the chart.

Analyst’s Expectations:

Direction: Bearish

Target: $2,004.62

Invalidation: $2,044.96

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

Bullish scenario: Intraday buys above 2160.00 with TP: 2171 and TP2: 2177 // Bearish scenario: Sells below 2177 with TP1: 2150, TP2: 2142, and 2126

This article uses price action and volume profile techniques to address a fundamental and technical perspective based on the daily chart analysis of spot gold (XAUUSD).

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!